Introduction

When it comes to managing finances for your small business, Countingup is a name that often comes up. This all-in-one solution combines banking and accounting into a single app, designed to simplify your financial management. In this post, we’ll dive into everything Countingup has to offer, exploring its features, pricing, and more, to help you decide if it’s the right fit for your business.

Features & Functionality

Because Countingup integrates accounting and banking into a single app, it is a distinctive solution that is perfect for freelancers and small business owners. A number of features in the app are intended to make money management easier.

Features of note:

- Current Account for Business

A business current account with a UK sort code and account number is offered by Countingup. You may make payments, manage your finances, and keep an eye on your cash flow in real time with this account. - Accounting that’s Automated

Countingup’s automated accounting mechanism is one of its best features. Without the headache of tedious manual data entry, the software automatically classifies your transactions to help you keep on top of your finances. This can minimise bookkeeping errors and save a substantial amount of time.

Pricing & Plans

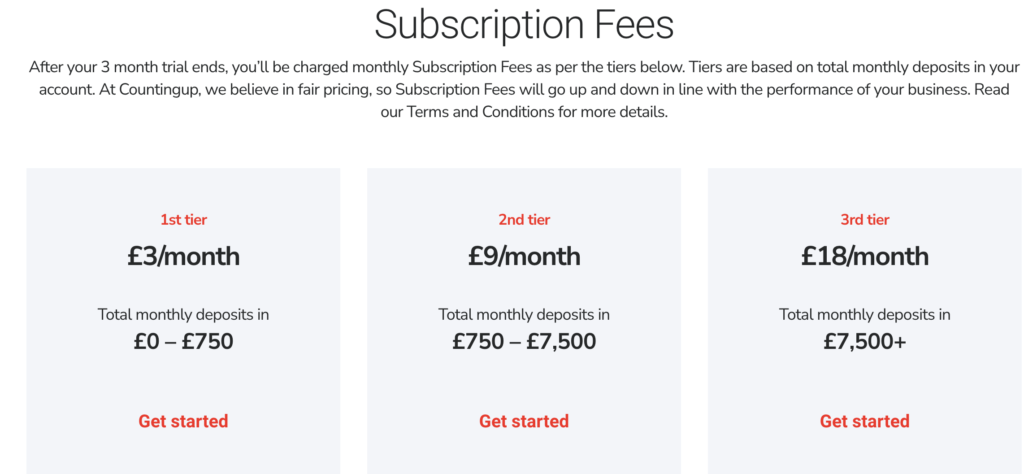

Countingup provides simple price levels that are tailored to freelancers and small enterprises. Determining whether Countingup is the best option for your financial management requires an understanding of the associated costs.

Asset Value Structure:

- No-Cost Sample*

With Countingup’s free trial period, new users can experience the app’s capabilities without having to commit right away. Before moving up to a paid subscription, this is an excellent method to make that the platform matches your requirements. - Subscription for a month

Countingup is priced on a monthly subscription basis, with tiers that vary dependent on the capabilities you require and the size of your company. The basic plan is a cost-effective choice for new businesses and lone proprietors since it includes all necessary accounting and banking functions.

User Experience (UX)

Countingup’s user experience (UX) is one of its strongest qualities because it was created with small business owners and freelancers in mind. The user-friendly interface and design of the software make financial management as simple as possible.

Usefulness

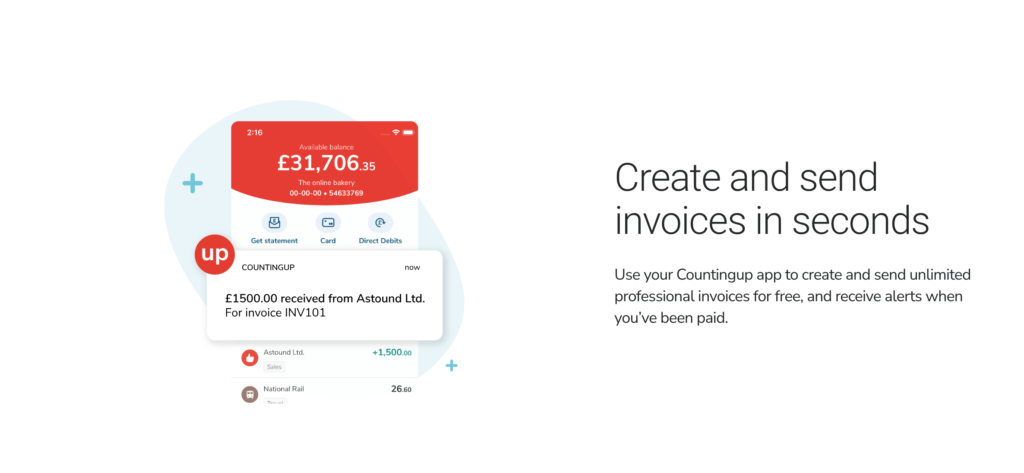

Countingup is an easy-to-navigate structure that even someone with little computing skills may use. With only a few clicks, you can access all of the main features, including viewing transactions, making invoices, and producing reports. This user-friendliness lowers the learning curve and saves time.

Mobile Application Usage

The Countingup mobile app offers complete functionality while on the road and is made to operate flawlessly on smartphones. From any location, users can send invoices, keep track of their spending, and manage their money. The responsiveness of the app

Security & Compliance

Security and compliance are essential for managing finances. Countingup takes these factors seriously and makes sure that your company’s data is secure and complies with all legal requirements.

Data Security

Countingup protects your financial information with industry-standard encryption. This lowers the possibility of unauthorised access by ensuring that all of your transactions, account information, and sensitive data are securely stored and transferred.

Multi-Factor Authentication (2FA)

Two-factor authentication is a security feature that Countingup provides (2FA). With this feature, in order to access your account, you must first authenticate yourself using a backup method, like a text message. In the unlikely event that your password is hacked, 2FA helps prevent unwanted access.

Financial Regulations Compliance

Countingup complies completely with all anti-money laundering and other UK financial legislation.

Integration & Compatibility

Countingup is made to integrate easily with various programs and systems that small companies often use. It is simple to link your financial management with other facets of your business operations because to its compatibility and integration options.

Accounting Software Integration

Countingup is compatible with Xero and QuickBooks, two well-known accounting programs. This makes it simple to move financial data between platforms, which minimises the need for human data entry and guarantees that your books are constantly current.

API Access

Countingup provides access to its API for companies with more sophisticated needs. This gives developers the freedom to link Countingup with other software programs or construct unique integrations, which is useful for companies that need specific configurations.

Payment Platform Compatibility

Because Countingup works with most popular payment systems,